Lead schedules

A lead schedule (also called a lead sheet) is a document that serves as a summary and index of the make-up of financial statement line items and related note disclosures. It is called a “lead schedule” because traditionally it was the front page in the relevant section of a file, cross referenced to supporting working papers and documentation filed behind it.

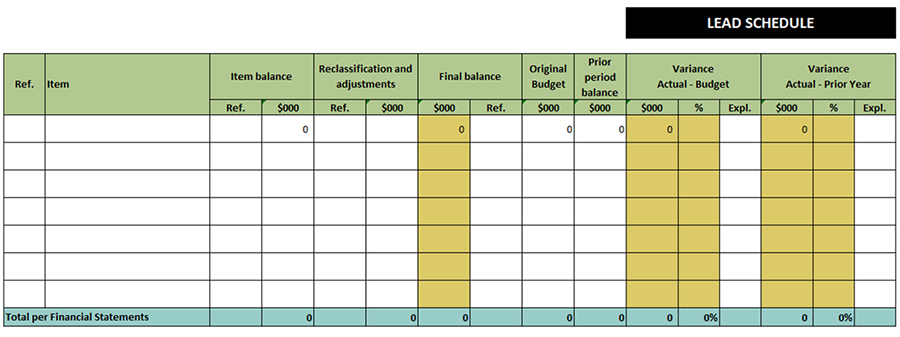

A lead schedule shows the general ledger (GL) accounts that are included in each financial statement line item and note disclosure. There would normally be one lead schedule for each financial statement line item or group of related line items. The total on the lead schedule should agree with the final balance in the financial statements.

The lead schedule provides a record of what was included in each line item. This provides a valuable reference point for your records. This can be especially helpful when there are staff changes in your finance team.

Below are some explanations of what to include in each column:

- Ref – Reference to supporting working paper or documentation.

- Item balance Ref – Reference to any supporting schedule that shows the make-up of the item balance.

- Item balance amount – this should agree to the trial balance.

- Reclassification and adjustments Ref – reference to supporting working paper or documentation for any reclassifications or adjustments.

- Final balance amount – this should agree to the final version of the financial statements.

- Original budget amount – this should agree to the originally approved budget from the start of the financial year.

- Variance explanations – Reference to explanation for any significant variances. Your audit team will advise you of the level of variance they will want explanations for.

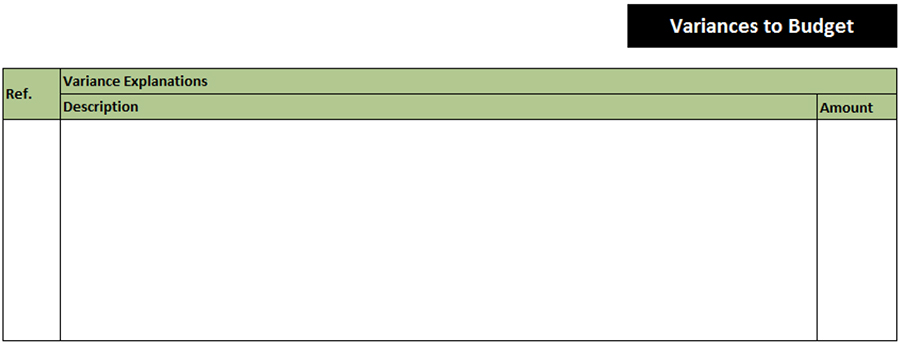

The lead schedule is also a place where significant movements for the year are explained and recorded for future reference. A good variance explanation would highlight what caused the variance and why. Ideally the impact of each cause is quantified to identify how much of the variance resulted from it.

The variance explanations are also used by the audit team as part of the process of understanding each financial statement line item and identifying potential risks. It is important that the reasons for significant variances are adequately explained so that the auditor can understand why there is a variance. The audit team may ask further questions and ask for evidence to corroborate the variance explanations. Below is an extract from the lead schedule where variance explanations can be documented:

Sometimes the reasons for variance may not be clear at the financial statement line item level, so it often advisable to break this amount down to the note disclosure level or similar more detailed level in a sub-lead schedule in order to analyse and explain the variances. The lead schedule template includes a worksheet where this can be done. This follows the same format as the lead schedule described above.

In some instances the variance between the current year and budget amounts may be the more relevant comparison, while in other instances it may be the variance between the current year and the prior year. If you have any uncertainty in this area, please liaise with your audit team.

One way of getting assurance that the lead schedules have been accurately prepared is having a quality assurance review and recording the various steps taken by both the preparer and reviewer. Below is an example of what can be included to document this:

Sign-off by the staff members preparing the information

| Yes | No | N/A | |

| All balances in the lead schedule agrees to: | |||

| - trial balance | |||

| - financial statements | |||

| Analytical review completed with accurate explanations. | |||

| Supporting documentation to support balances completed and on file. | |||

| Section ready for auditors to look at. | |||

| Other comments: | |||

| Section prepared by: | |||

| Section reviewed by: | |||

Information required

- Completed lead schedules for each line item in the financial statements.

- Completed sub lead schedules for all note disclosures relating to each of the line items in the financial statements.

- Descriptions and explanations for the variance identified in the lead schedules between the current year amounts when compared to the budgeted and prior year amounts.

- Evidence of the review of the lead schedule.